Your Louisiana Underpayment Specialist

Getting You Paid Your Full Negotiated Contract Rates

If you had the chance to increase your revenue by 10-20% of total net patient revenue for no cost, would you? With our industry-unique underpayment recovery system, YOU CAN!!! Our forensic audit and recapture software has successfully recovered significant revenue for all of our clients and can do the same for you at NO COST.

Recapture Underpaid Insurance Payments

Southern EVALS and ADHC UNDERPAYMENT RECOVERY SYSTEM

Our team of payor contract experts and our advanced forensic audit software analyzes every remittance received over a 12-to-24-month period to ensure contractual compliance and identify underpayments for our clients.

Click this video to learn more

Collaborative Addition to Your Revenue Cycle Management Program

Our state of the art underpayment recovery service offers a seamless and secure addition to your Revenue Cycle Management (RCM) program.

- Our thorough examination is conducted on remittances once all other Revenue Cycle Management (RCM) strategies have been exhausted, including any internal or external initiatives to recover underpayments.

- We only engage remittance files with no expected further revenues.

- As a result, our services seamlessly integrate with existing RCM strategies, consistently generating new revenue opportunities 100% of the time.

Our results speak for themselves. To date, we have analyzed billions of dollars in reimbursements and remittances against thousands of unique and often complex payor contracts and have found noncompliance and underpayments for 100% of our clients. What does that mean for our clients? The typical result is 10%-20% of gross payor receipts in recovery.

We work solely on a contingency basis. There are no upfront fees, costs, or ongoing tasks required from our clients. We take on 100% of the risk and effort to recover revenues for our clients. We are only compensated when we successfully recover underpayments. THATS RIGHT! We only get paid if we find you $$$.

THE BIG 3

Our Medical Underpayment Recovery system consists of the following three core service components that have had a 100% success rate in finding and collecting additional insurer payments from CLOSED-OUT payments.

Forensic analysis

Our contract specialists load the payment rates and terms of the healthcare provider's existing Payor Agreements in the Contract Module.

We work with your Billing Department and its claim Clearinghouse to upload its ANSI ASC X12 837/835 electronic files using our HIPPA-compliant, proprietary encryption platform

Using these two sources of critical data, our team of experts and software logic identifies variances in the payment reimbursement and your contractual agreement with the Payor. The resulting data is organized in an easy-to-use, understandable format.

As your partner, we will work closely with your staff to strategize and devise a plan to recover revenue lost due to underpaid, suspended, and incorrectly denied claims.

Contract Modeler

Our Contract Modeler is designed to "plug and play" reimbursement scenarios, rates, and contract terms using historical claim utilization data to determine revenue outcomes based on a provider's specific case/service mix.

This valuable tool allows the healthcare provider to assess the payor's contract proposal's impact and identify opportunities to maximize revenue.

Our team of specialists is composed of experienced professionals having worked in administration, operations, and contracting with major payors.

Additional consulting services, as well as contract negotiation services, are available if needed.

Analytics / Reporting

All data elements captured in the electronic 837/835 files are defined by CMS and housed in a secure client-specific environment on our HIPPA-compliant/encrypted server.

We offer a suite of standard claim utilization reports and the ability to provide customizable, user-friendly reports.

This comprehensive capture of all data related to a healthcare service experience provides a picture of the healthcare provider's need to evaluate current and future operations.

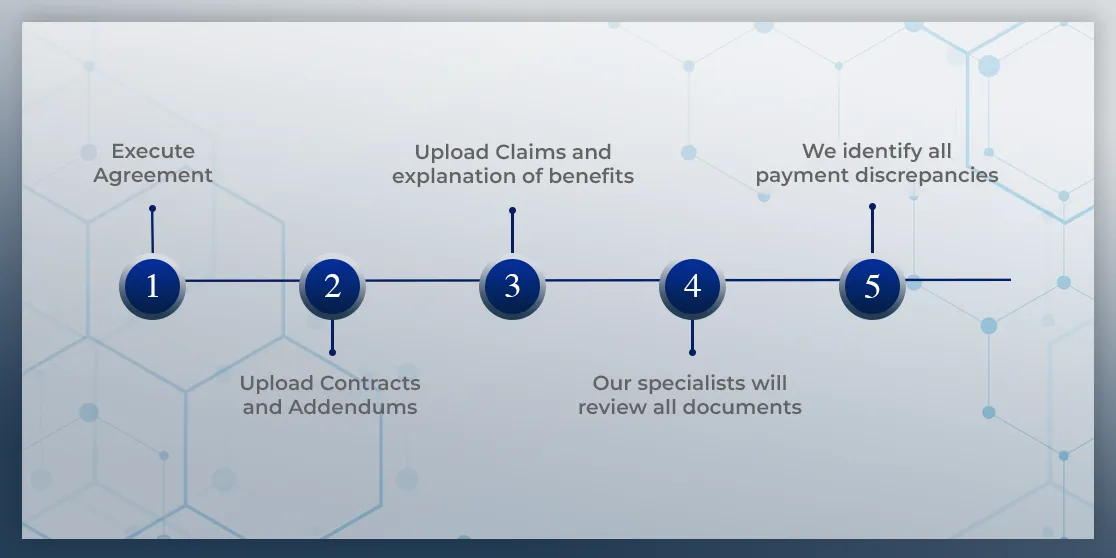

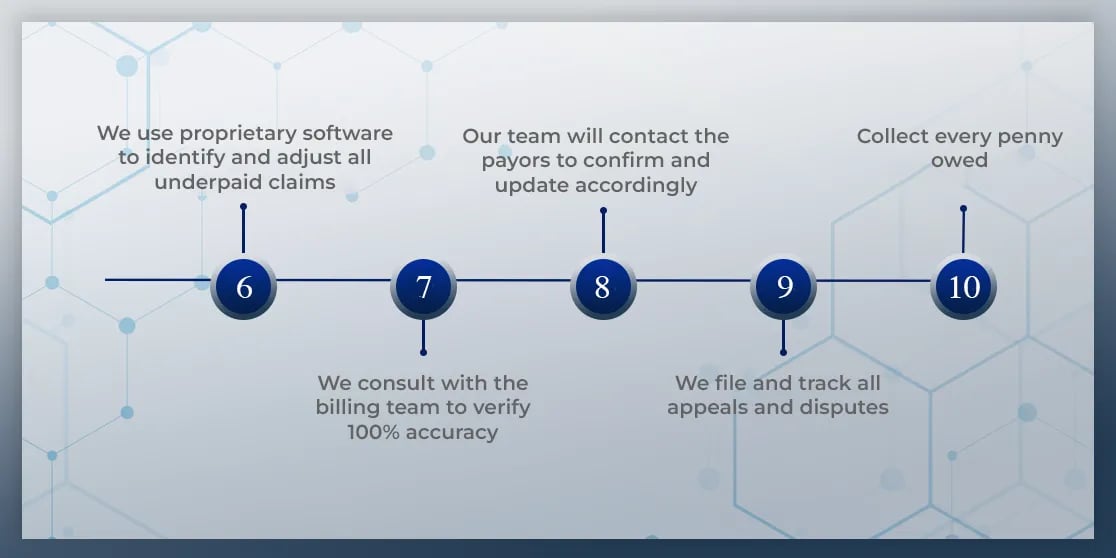

What Does The Process Look Like

Step by Step

Get in touch with us

My name is Taylor Cottano. As someone with experience in hospitals, and health centers, I'm acutely aware that every medical provider situation is different - which is why cookie-cutter solutions seldom work.

It's our system's ability to customize both its software and subject matter experts to your organization's unique receivables situation that sets it apart. It also explains its unrivaled success in finding and collecting payments from CLOSED-OUT payments and incorrectly denied claims 100% of the time.

This is why we're comfortable promising no fee if it fails to do so.

But we do need to get to know you better to maintain that track record of success if you decide to add this to your current revenue cycle management (RCM) measures - or maybe to jumpstart them if you haven't yet begun with RCM.

For over a decade we have been helping our clients increase revenue and maximize efficiency. We would love the opportunity to do the same with yours!